As of now, the top bitcoin holder is purported to be the anonymous Satoshi Nakamoto (who is Black, in some circles). Nakamoto and the nine other bitcoin investors are said to hold 5.5% of bitcoin supply. Currently there are about 6.5 million bitcoins in existence, worth about $71 million US dollars. As the currency grows, it’s no guess the online illegal market, hacking, and financial scheming will as well.

How Do We Calculate Our Cryptocurrency Prices?

On social media platforms, a hashtag search generates thousands of people — from novice investors to finance leaders — discussing their approaches to cryptocurrencies. Some voices caution against the currencies for those looking to make money immediately. More than anything, they’re a way to start conversations about traditional investment techniques, such as stock trading, and simple routines for saving money. The horizontal bars represent each market lifetime, i.e., the time when the market becomes active until its closure, and is colored according to the market’s monthly trading volume in USD. In the vertical axis, markets are in the chronological order of their launch date, although for some markets the activity effectively starts after the launch date (e.g., AlphaBay).

- Drugs including cocaine, heroin, and methamphetamine are manufactured and smuggled worldwide, with criminal organizations having a tight grip on the control of the supply chain.

- At its core, the protocol leverages the Theta Blockchain Ledger Protocol, which is known for its efficiency and security measures.

- Prior to the disbanding of the DOJ’s National Cryptocurrency Enforcement Team and the scaling back of prosecutors’ ability to bring criminal charges against crypto firms, the federal government had seized billions of dollars in cryptocurrencies.

- A huge shortfall in government revenue collection has become a significant challenge for the black market because transactions are outside the legal economy.

- As cryptocurrencies find their way into banks, payment systems, retirement plans, and even local infrastructure, the risks they pose are beginning to surface in ways that can impact ordinary people.

Illegal Activities

Through his scheme to defraud, ZHONG was able to withdraw many times more Bitcoin out of Silk Road than he had deposited in the first instance. As an example, on September 19, 2012, ZHONG deposited 500 Bitcoin into a Silk Road wallet. Less than five seconds after making the initial deposit, ZHONG executed five withdrawals of 500 Bitcoin in rapid succession — i.e., within the same second — resulting in a net gain of 2,000 Bitcoin. As another example, a different Fraud Account made a single deposit and over 50 Bitcoin withdrawals before the account ceased its activity. ZHONG moved this Bitcoin out of Silk Road and, in a matter of days, consolidated them into two high-value amounts. Availability of the crypto-assets displayed is subject to jurisdictional limitations and specific terms and conditions.

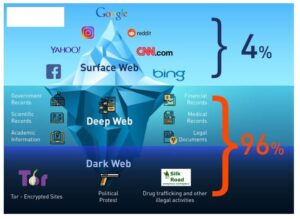

What Is A Darknet Market?

BLACKHOLE PROTOCOL has experienced several significant milestones that have contributed to its development and expansion within the cryptocurrency market. Initially, the protocol marked its entry into the blockchain space with the successful completion of smart contract deployment, followed by an official project launch. This foundational step was crucial for establishing the protocol’s presence and operational capabilities. Few people are willing to pay higher prices now, especially after the FTX debacle.

Arrest And Trial Of Ross Ulbricht

Its commitment to privacy, diverse product offerings, and robust security measures make it a preferred choice for users seeking discreet transactions within the darknet. Despite those provocations, financial regulators have kept mum about the project. The New York Department of Financial Services, which held hearings about bitcoin in January and says it plans to create a “bitlicense” for some bitcoin-based businesses, didn’t respond to a request for comment. The study also provided insights into the slim demarcation between legal and illegal market aspects, especially in white-collar or financial market crimes. Within the parameters of entirely legal market structures, illegal activities can take place undetected or unpunished. Personal networks are the preferred system; it virtually exists on a bond of trust.

The Dark Side Of Cryptocurrency: How Digital Assets Fuel Money Laundering And Illicit Trades

From the last quarter of 2013, U2U-only sellers become the largest category of sellers and remains as the largest throughout the rest of the observation period. The large number of U2U-only sellers is in accordance with previous results that showed that the trading volume in the U2U network is significantly larger than that of DWMs13 (also see Supplementary Information Figure S8). Although it only existed for two years, Silk Road will forever be one of the most famous moments in crypto history. For better or worse, it solidified Bitcoin as a network that could support “free” and anonymous activity, no matter how legal.

As the crypto industry evolves, fostering transparency and proactive security strategies will be essential to building trust and ensuring a safer investment environment. The cryptocurrency space remains vulnerable to scams that exploit investor trust and security weaknesses. Fraudulent ICOs, rug pulls, and phishing attacks deceive users through false promotions and impersonation tactics. These threats highlight the need for stronger security measures, regulatory oversight, and increasing user awareness.

Enhanced Law Enforcement

When German authorities arrested the site’s alleged operator in January this year, they also seized valuable evidence of transactions which led to this week’s arrest of key players. Additionally, The Financial Action Task Force (FATF) enforces Anti-Money Laundering (AML) and Know Your Customer (KYC) measures to enhance transparency. The Travel Rule mandates transaction disclosures, aiding law enforcement in tracking illicit funds.

Telegram Bans 2 Black Markets That Have Generated $35B Through Selling Stolen Data, Laundering Crypto

“There is a ‘go dark’ problem, and we’re going to have it with bitcoin. That’s what bitcoin is for. That’s what we want to see.” They chart a 66% increase in the illegal ivory trade that aligned with the announcement of legalizing ivory sales. Further study of various data available on the black market implies that an increase in elephant poaching was linked with the legal sale.

However, their anonymity facilitates illegal use such as money laundering, fraud, and ransomware payments. Despite Haowang Guarantee’s closure, affiliated dark marketplaces remain active. Xinbi Guarantee continues to operate on new Telegram channels and is attracting increased user activity. Elliptic co-founder Tom Robinson described the shutdown as a “game-changer” for combating online fraud. Meanwhile, the firewall that once separated crypto from traditional banks is beginning to break down. Major banks are already looking to do more business with crypto firms and are courting clients for initial public offerings (IPOs).

While the most severe consequences may still lie ahead, the window to contain them is narrowing. In the meantime, millions of everyday investors are already facing immediate dangers due to a lack of protections for investors and consumers in crypto markets, which is a challenge that also requires urgent attention. That’s why ongoing legislative debates around stablecoin regulation are so important. Such a move could expose consumers, banks, and even the broader financial economy to cascading failures during periods of stress. Meanwhile, banking regulators—such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC)—are pulling back guardrails on banks’ crypto activities. And public officials and politically connected individuals on both sides of the aisle have developed close ties with the crypto industry.

I don’t think the future of crypto privacy depends on the outcome of this one case. There will be other decentralized mixing services, and there are tools like ZCash and other alternative cryptocurrencies that already seem to be very hard to trace. As these tools gain more adoption, there will be new both technical and policy battles over this stuff.

The black market represents almost a fifth of the global economic activity, a National Bureau of Economic Research study states. Authors Solomon Hsiang and Nitin Sekar, in “Does Legalization Reduce Black Market Activity? Evidence from a Global Ivory Experiment and Elephant Poaching Data,” go on to evaluate the first-ever global legalization experiment carried on in an internationally banned market.

Digital Black Markets

We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens. Whether the two markets succeed in relaunching, Robinson notes, will depend largely on how serious Telegram is about its efforts to prevent them from using its messaging services. And as the volatility in value proves, it’s hard to have a lot of faith in a bitcoin from day to day, which is the cornerstone of a currency’s success. More and more people are treating bitcoin as an investment vehicle like a stock or bond than a currency. It was estimated in 2022 that the percentage of illicit transactions is about 23%, with a value of 72 billion US dollars.