Passwords are among the most commonly leaked pieces of sensitive personal information. You can use Aura’s free Dark Web scanner to see which accounts are at risk. Then, for added security, enable 2FA on every account that allows it — especially your online bank, email, and social media accounts. Criminals often use stolen SSNs to file fraudulent tax returns and claim refunds. The dark web—a hidden part of the internet accessible only through specialized software—is a marketplace for stolen personal information, including SSNs, credit card details, and account credentials. You can change your SSN but the SSA only allows this under specific circumstances.

Expert Does Your Taxes

You can freeze and unfreeze your credit report for free, but you’ll need to contact each credit bureau separately to implement the freeze. Social security information is often used for financial fraud, particularly related to insurance and credit cards. Suspicious banking activity is one of the first signs that something might be up. Cybercriminals can use your personal information to take out loans in your name, claim your tax returns, or open new credit cards. Since they obfuscate their activities using your name, this digital footprint would be tracked to you. If fraudsters are using your stolen SSN, it will most likely show up on your credit reports and bank or credit card statements.

Set Up Fraud Alerts

Victims may face ongoing challenges with their credit reports, financial security, and even their employment prospects. Rebuilding your credit score and clearing your name of fraudulent activity requires time, persistence, and often legal assistance. If you need access to your credit but still want some protection, consider setting up a fraud alert. This is a free notice you can place on your credit report that lets creditors know you’re at a higher risk for identity theft and requires that they verify your identity before approving new credit applications. If your SSN was found on the dark web, you are most likely concerned about your identity being stolen. This form should be used if your Social Security number has been compromised and IRS has informed you that you may be a victim of identity theft tax fraud, or your e-file return was rejected as a duplicate.

The Impact Of The SSN Exposure

A cybercriminal group called “USDoD” exposed a database owned by National Public Data, a background check company, on a dark web forum. Information security company McAfee reported that it hasn’t found any filings with state attorneys general. Some states require companies that have experienced data breaches to file reports with their AG offices.

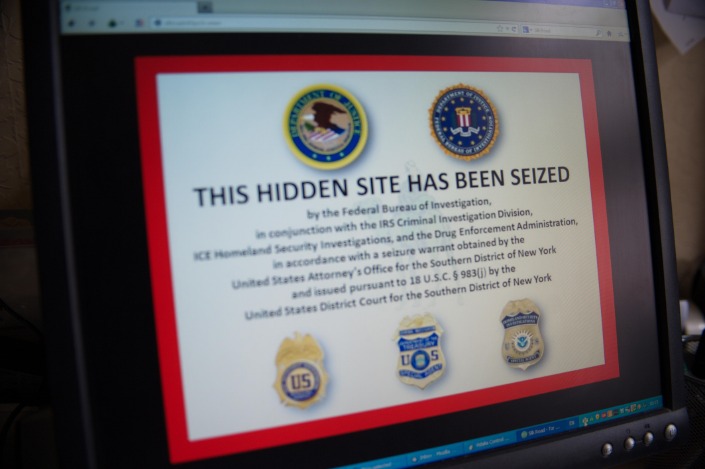

- Understanding how the dark web operates and the types of illegal activities that take place can better equip individuals to protect their personal information and stay safe online.

- Stefan Lembo-Stolba leads Experian Consumer Service’s data research on Ask Experian, publishing insights based on Experian’s credit data of over 220 million U.S. consumers.

- The information can be used to open fraudulent accounts, apply for loans, or even commit tax fraud.

- If this happens, contact the company immediately and report the fraudulent activity.

- Freezing your credit reports limits access to your reports and keeps creditors from checking your credit in response to a new application.

- Some financial companies, such as Credit Karma, can also help you freeze your credit.

It’s unlikely that criminals will care to remove one data point from a single user request – even if you were able to find a way to contact them. Personal information is more valuable when it comes in large datasets, and hackers are more likely to use it as ransom to obtain money from breached companies. The best chance to remove your SSN from the dark web is to get law enforcement involved, such as the FBI or the FTC, but even that is not a guaranteed solution.

Hacker Offers To Sell 158 Million Plain-Text PayPal Credentials On Dark Web Forum

If you think you’ve been a victim of identity theft, you should contact the Federal Trade Commission and file a report. Look for any unusual activity, such as new accounts or charges you don’t recognize. If you see anything suspicious, contact the credit bureau and file a dispute. You’re entitled to a free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—once every 12 months. When you’re done changing your passwords, the next thing you should do is check your credit report.

Reporting The Incident

When a data breach occurs, cybercriminals can gain access to databases containing SSNs and other personal details. That strategy is reason enough to protect your passwords and use passkeys whenever possible. Regularly monitor your credit reports and financial statements for any suspicious activity. If you’re concerned that your data’s been being used against you, it’s time to use an identity theft protection and credit monitoring service to protect yourself.

Protect Your Computer With Security Software

Some organizations might reimburse you, but you won’t always have legal recourse if they don’t. You generally aren’t liable for unauthorized credit or debit purchases, but you may need to act quickly and call the financial institution to dispute the transactions. If you notice a new account was opened in your name, the company can also help you close the account. However, mobile phone carriers now offer extra security measures that can help protect you from SIM swapping attacks.

Fox News’ Danamarie McNicholl reports on a lawsuit against National Public Data that alleges hackers gained access to names, mailing addresses and Social Security numbers. Aura’s service does not monitor for all content or your child’s behavior in real time. If you don’t feel safer after signing up for Aura, we offer a 60-day money-back guarantee on all annual plans — no questions asked. If the worst should happen, all Aura plans include round-the-clock U.S-based support and up to $1 million in identity theft insurance to cover eligible losses and expenses. Identity Protection PINs (IP PINs) stop someone from filing tax returns by using your SSN or Individual Taxpayer Identification Number (ITIN).

- Aura’s service does not monitor for all content or your child’s behavior in real time.

- It’s a hub for cybercriminals to trade stolen data, including Social Security numbers (SSNs), credit card information, and login credentials.

- A credit freeze prevents anyone from accessing your credit file — which means that scammers won’t be able to ruin your credit score.

- If you have to provide your number over the phone, make sure you’re far away from other people who could hear it.

- As identity thieves become more advanced, you need to combine personal information protection, document handling, and cybersecurity best practices to protect your SSN.

This could allow scammers to bypass two-factor authentication (2FA) security on your accounts — as any codes would be sent to a phone that they control. A Dark Web monitoring service like Aura periodically scans Dark Web forums and websites for your personal information and then sends you notifications whenever anything suspicious is detected. Sign up for a free 14-day trial to start monitoring the Dark Web for your data right away. If your SSN has been compromised, you’ll want to keep close tabs on your financial accounts to ensure they haven’t been illegally accessed.

What You Can Do To Protect Your Personal Information

If you do get a new SSN, it can affect your earnings history and credit, making it more difficult down the line to apply for legal documents and passports. Sign up for our newsletter and learn how to protect your computer from threats. Beyond the financial and privacy implications, SSN exposure can also cause emotional distress and consume significant time and resources to resolve.

Before delving into the action steps, it’s important to understand the dark web and why finding your SSN there is cause for concern. If you find you’re included in the breach, the steps you should take are not necessarily new. By entering your name, you may get a sense of what information, if any, has been shared.

How To Keep Your Banking Information Safe And Secure

In fact, the Federal Trade Commission (FTC) reported that incidents of identity theft where the victim was under age 19 increased 50% last year. Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.